- Otc smart card balance how to#

- Otc smart card balance drivers#

- Otc smart card balance software#

- Otc smart card balance plus#

- Otc smart card balance free#

Examples of approved food items are fruits vegetables, meats, poultry, seafood, eggs, dairy, rice, pasta, beans, and much more. Purchase healthy foods from participating retailers and farmer’s markets. Member Portal Provider Portal Broker Portal Employer Portal No One Knows New Yorkers Better Than We Do.Find a Healthfirst Health Plan that Works for You.Looking for a Medicare Advantage or Managed Long-Term Care Plan?.Medicare Advantage Plan Coverage Decisions, Appeals and Complaints.Lincoln Medical and Mental Health Center.Woodhull Medical and Mental Health Center.SUNY Downstate’s University Hospital of Brooklyn.Healthfirst Medication Therapy Management (MTM) Program.When Are You Eligible To Enroll In Medicare?.Healthfirst’s Online Accessibility Statement.Healthfirst Signature (HMO) The Medicare Advantage plan with more choice and flexibility.Healthfirst Certificates of Coverage for Commercial Health Plans.Subscriber Contracts & Schedule of Benefits (SOB).The Healthfirst NY Mobile App-healthcare access on the go!.Prescription Delivery – Medicines Delivered To Your Home.

Otc smart card balance how to#

Otc smart card balance free#

Otc smart card balance plus#

Otc smart card balance software#

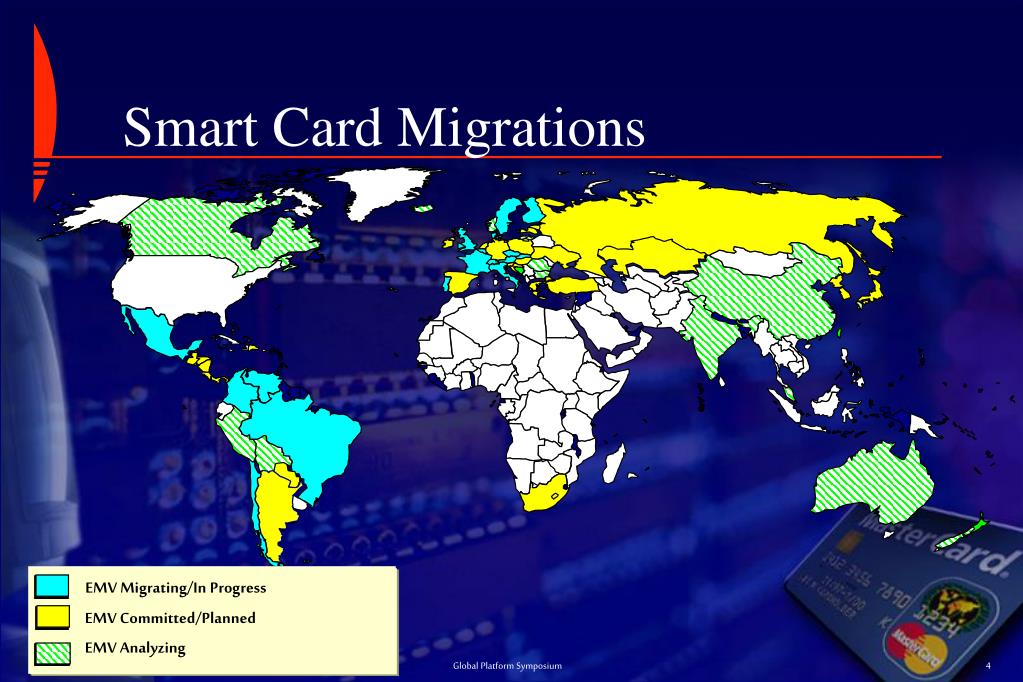

is a former subsidiary of Performance Optician Software Corporation. The company was founded in 2006 and is based in Wilmington, Delaware. to deliver an AI driven fraud detection system to banks and financial institutions. has strategic partnership with Quotientica Pvt Ltd. In addition, the company offers advisory and product development services. It also provides VelocityMPOS, a customizable EMV MPOS solution for Retail or On the Go business and for individuals and businesses to create and publish articles. The company offers EmphasisPay that delivers advisory and technology solutions for payment acquirers and issuers Mtickets.events that allows users to create an event or events and issue mobile tickets, a web publication portal and mobile platform that enables retailers, property managers, and event promoters and, a remote check deposit solution. Smart Card Marketing Systems Inc., doing business as PaymentActiveNetwork, operates as a fintech solutions provider that delivers a cloud-based EMV MPOS, and EPOS Host platform to issuing and acquiring banks, telecoms, and global enterprises.

We calculate exposure to Smart Card's market risk, different technical and fundamental indicators, relevant financial multiples and ratios, and then comparing them to Smart Card's related companies. As compared to an absolute model, our relative valuation model uses a comparative analysis of Smart Card. In some cases, mostly for established, large-cap companies, we also incorporate more traditional valuation methods such as dividend discount, discounted cash flow, or asset-based models.

Otc smart card balance drivers#

By analyzing Smart Card's financials, quarterly and monthly indicators, and its related drivers such as dividends, operating cash flow, and various types of growth rates, we attempt to find the most accurate representation of Smart Card's intrinsic value. In general, an absolute valuation paradigm, as applied to this company, attempts to find the value of Smart Card Marketing based exclusively on its fundamental and basic technical indicators. We use both absolute as well as relative valuation methodologies to arrive at the intrinsic value of Smart Card Marketing. The P/E ratio is the most commonly used of these ratios because it focuses on the Smart Card's earnings, one of the primary drivers of an investment's value.Ībout Smart Card ValuationThe equity valuation mechanism determines the current worth of Smart Card Marketing on a weekly basis. The reason why the comparable model can be used in almost all circumstances is due to the vast number of multiples that can be utilized, such as the price-to-earnings (P/E), price-to-book (P/B), price-to-sales (P/S), price-to-cash flow (P/CF), and many others. Still, instead, it compares the stock's price multiples to a benchmark or nearest competition to determine if the stock is relatively undervalued or overvalued. This model doesn't attempt to find an intrinsic value for Smart Card's OTC Stock. Comparative valuation analysis is a catch-all model that can be used if you cannot value Smart Card by discounting back its dividends or cash flows. It is rated below average in price to earning category among related companies. Smart Card Marketing is currently regarded as top stock in price to sales category among related companies.

0 kommentar(er)

0 kommentar(er)